Financing

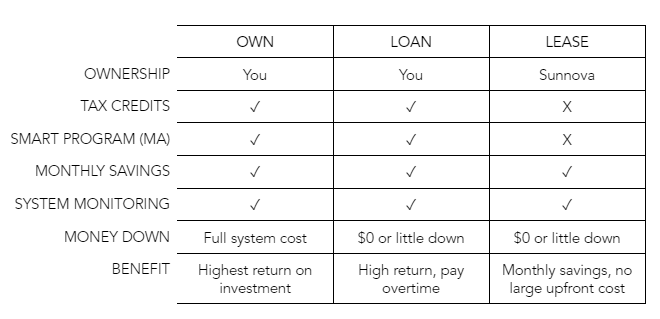

Going solar saves you money and is a great investment, whether you own the system or lease it. Here’s a guide of the financing options available. If you have any questions about what might be best for your personal situation feel free to contact us and we’d be happy to give you our recommendation and answer any questions you may have.

OWN

Purchasing a system outright or taking out a loan typically provides the most savings in the long-run. When purchasing with cash or financing your system with loans, you will benefit from the tax credits and incentives for your solar array, drastically cutting down the cost of your investment.

LOAN

Loans are a great way to get all the benefits of owning a solar array without the upfront cost. There’s the UMASSFive Solar Loan that can even include the cost of a new roof or other solar related projects. Once all the incentives are accounted for, a Solar loan can be structured to be a lower monthly payment than your current electric bill, saving you money on your monthly expenses right away. Purchasing a solar system with cash or loan provides the highest return on investment and also increases the value of the home or business significantly.

Reasons you may want to own your solar array:

- You are willing to spend money upfront or get a loan to maximize your investment and save thousands

- You want to increase the value of your home.

- You qualify for the solar tax credits

LEASE

If you opt for a lease you can go solar with little to no initial cost. A solar lease is generally a 10-20 year commitment. There is a fixed monthly rate for leasing solar panels. The lease payments are designed to be lower than your electrical bill, so you save about 10-30% from what you were spending on electricity costs, without spending money upfront. You are also not responsible for the maintenance of the system. Unlike purchasing solar, when you lease a solar PV system you will not receive tax credits or qualify for incentive programs. However, you will still see significant savings from going solar whether you lease or purchase the system.

When Should I Lease a Solar Array?

- You want to go solar, but do not have the cash upfront or do not have access to a well-structured loan.

- You are a non-profit organization, and cannot take advantage of solar tax credits and deductions.

- Your federal income tax liability is lower than the value of the solar tax credit.

POWER PURCHASE AGREEMENT (PPA)

A Power Purchase Agreement is similar to a lease and usually lasts between 20-25 years. This agreement allows the installation of a solar energy system on your property at little to no cost to you. You purchase the power generated from the panels to you at a fixed rate that is typically lower than your utility’s rate. However, you do not receive tax credits or other incentives generated from the system. Just like a lease, Sunnova remains responsible for the operation and maintenance of the system for the duration of the agreement.

Why Should I Consider a Solar Lease/PPA?

- You are ineligible for federal or state investment tax credits resulting from your investment in a solar panel system.

- You want to avoid the responsibility of maintenance or repairs for a solar panel system;

- You do not want to wait until the following year to receive the financial benefits of tax credits.

Regardless of what route you take, going solar can drastically reduce, and in some cases entirely eliminate, your electric bill. Going solar also reduces your dependence on fossil fuels which are not only increasing in cost but not good for the environment. Still not sure what financing option is best for you? Give us a call at 1-800-223-1462 and we would be happy to discuss which option would best fit your personal situation and answer any questions.